The notion of having one’s own savings account is commonplace to us modern folk. But for former slaves—many of whom had never even seen money—it was an alien concept. And, in a country that runs on capitalism, getting the hang of money management was (and is) essential to survival. Enter the philosophy behind the establishment of the Freedman’s Bank.

The roots of savings banks for African Americans happened during the Civil War when the regimental paymasters of black military units were authorized to permit all soldiers to allot a certain part of their pay to a relative or to the government for savings that would be paid back to the soldiers when they were discharged.

The first official bank exclusive to African-Americans was the Free Labor Bank, established in New Orleans in 1864. Those who could deposit were African American soldiers and free men of color who owned property in New Orleans. Other depositors included “half-free” African Americans who worked for wages on plantations in Louisiana under federal control. Proceeds from the plantation sales also went into the bank. It was many former slaves’ first experience in handling money.

In Virginia and South Carolina, African American soldiers and recently freed slaves could deposit into military savings banks. When the war ended, however, one of the banks still had $200,000 remaining because the soldiers who had deposited had either died and relatives could not be found, or they had been transferred to other posts or mustered out of service and had not realized they could withdraw the funds. The “mechanics” behind banking was still a new idea to most recently freed people.

At the end of the war, something had to be done to safeguard these large, unclaimed deposits. Also, since large sums of pay and bounty were due to African American soldiers, a plan needed to be devised to help them save what they would receive. A few white businessmen and philanthropists got together and came up with the idea to merge all of the above initial banks into one savings institution: The Freedman’s Savings and Trust Company (colloquially known as The Freedman’s Bank).

Use of the bank would be restricted to African Americans, and the original intent of the bank was very noble, with a system of transparency that seemed impervious to corruption. The officers would travel through all the southern states and African American districts, establish branches, and solicit savings deposits that could be withdrawn by the depositors at will. The future trustees sent a proposal to Congress and, on the same day in 1865, Abraham Lincoln signed a bill establishing both the Freedman’s Bank and the Freedmen’s Bureau, an early welfare system that helped freedmen with myriad issues of survival.

In all, the bank had 33 branches, mostly located in the south. The headquarters of the bank started out in New York City but was moved to Washington, D.C. in 1868. In time, about half of the bank employees were African American. Nearly every branch had an advisory council or board of directors of black property holders. To each depositor, a passbook which recorded deposits and withdrawals was given. After a few years, almost 72,000 people were making deposits to the bank.

Which brings me to why this is interesting for genealogical research. The “depositor signature books” of the surviving Freedman’s Bank records are virtually mini-biographies of the people who applied for a savings account. The signature books—available to examine for free at FamilySearch.org—often contain information about the applicant’s former slave owner, the person’s spouse and children, and personal details that can be found nowhere else; job skills, personal injuries, etc. In researching one’s slave ancestors—about whom notoriously little was recorded—this can be a gold mine.

Yet, even though there were 72,000 people using the bank, the population of African Americans at the start of the Civil War was approximately 4.4 million. This means you might want to temper your expectations in finding your ancestor in these records, as only about 2% of African Americans were using the Freedman’s Bank, and they were mostly living near the cities that had Freedman’s branches. But it’s always worth a try!

Although the bank and Freedmen’s Bureau were separate institutions, they were spun as being one-and-the-same in order to solicit more deposits into the bank. However, the Freedmen’s Bureau was a public, government institution, and the Freedman’s Bank was a private institution and not protected by the government. The bank’s existence had been granted by Congress, but the depositors’ funds were not insured by Congress. This detail was not brought to the forefront when the officers of the bank tried to get African Americans to deposit their money and, therefore, depositors felt like their investment was completely safe.

Although the intentions were noble, there were grave weaknesses. The system was too rapidly expanded and only about half of the branches were able to pay their expenses; some of the officials were corrupt, and more were inept; inspections were infrequent; bad loans were made and the available funds were invested in poor securities; the rate of interest paid to depositors was too high; the organization was unwieldy and the central administration found it difficult to control the branches; the purchasing of offices, equipment, and a large Washington D.C. banking house was excessive. The books that were kept were a mess, due to incompetence, fraud, and embezzlement.

In 1873, depositors became alarmed and three serious runs to retrieve their money were made within 18 months—including withdrawals by the trustees. Real estate value declined, so the non-securities investments lost money, and bad loans could not be called in. African Americans became increasingly uneasy, so fewer deposits were being made.

Frederick Douglass was made president of the Bank in 1874, later remarking it was as if he had “married a corpse”. He took the post not because he had any experience in banking, but because he thought his influence might strengthen the institution to weather the storm. When he learned that the trustees had withdrawn their deposits, he told Congress the bank had failed and must be closed. The finance committee agreed with Douglass and appointed three commissioners to orchestrate the closure of the bank. There was some talk of reorganizing the bank into a new institution, but they gave up the ghost and the bank was closed in 1874.

The U.S. Government was not bound—contrary to what the depositors had been told—to make good on any losses. At its closure, the bank owed 61,144 depositors $2,993,790. It only had $32,089 in cash; the rest was in personal and real estate loans that could only be realized after a long delay.

Depositors would be paid back according to their passbooks, rather than the branch ledgers because those were in such a mess. So the depositors turned in their passbooks and, after seven years of the bank’s closing, the depositors counted themselves lucky if they received back 60% of what they’d put in. Many of the less knowledgeable, smaller depositors simply gave up when they heard they could not immediately withdraw their money. The failure of the bank—although truly a great notion to get a disenfranchised people on its feet—did much to shake the trust of the African American community.

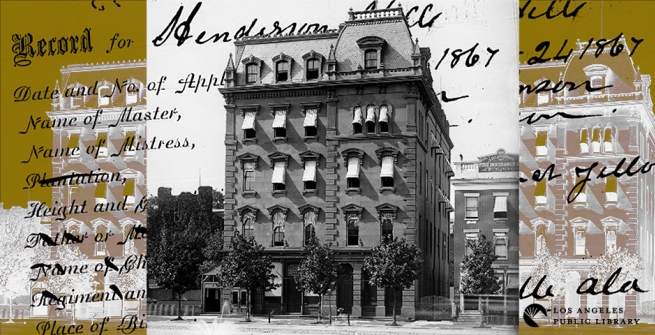

However, as is the case with other failed or misguided measures (see my earlier blog post on slave insurance policies), we strive to retrieve information from the records they leave behind. The digitized signature book snapshots accompanying this article reveal the lives of two people who might have disappeared from history were it not for the Freedman’s Bank. They show us that Henderson Hill and Dilla Warren were striving to make their lives better and move forward into the new world thrust upon them. If Henderson and Dilla are your relatives, this is what we would call “a find!”

Books and Sites

- The Freedmen's Savings Bank: A Chapter in the Economic History of the Negro Race by Walter L. Fleming

- United States, Freedman's Bank Records, 1865-1874 | FamilySearch.org

- African American Freedman's Savings and Trust Company Records | FamilySearch Research Wiki

- The Freedman's Savings and Trust Company and African American Genealogical Research | National Archives

- Mapping the Freedmen’s Bureau: Freedman’s Bank Branches (map)